Maximise the value of your Business

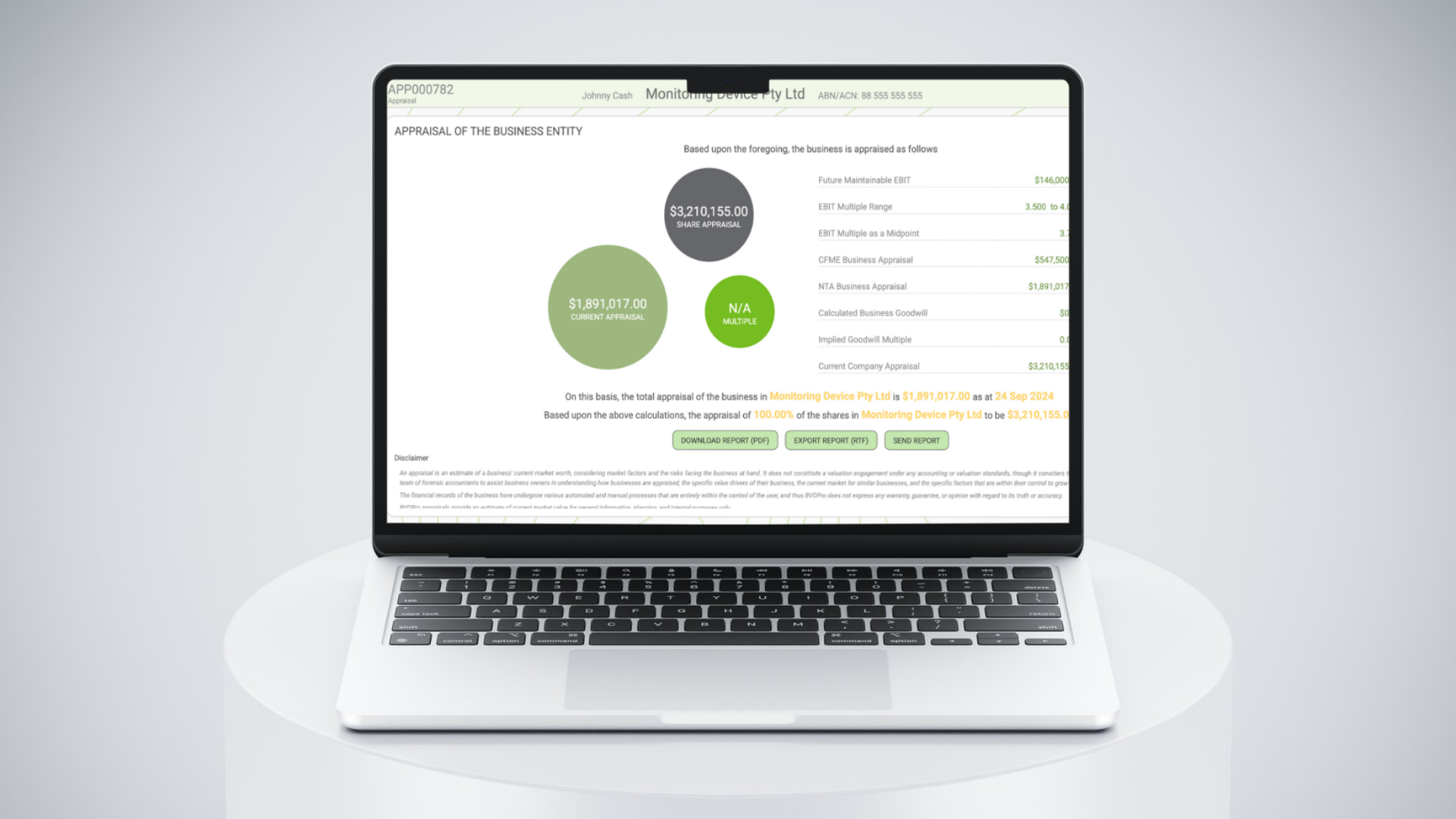

Discovering the value of your business with Business Valuations Online is simple and efficient. We have successfully valued over 1,000 businesses, providing fast, reliable, easy-to-understand reports designed for small to medium enterprises.

Our achievements & milestones

If information is power, then a business valuation makes you very powerful indeed.

At Business Valuations Online, we understand that the strength of our services is amplified by the expertise of our team. Led by Brett Goodyer, our approach combines over three decades of industry experience with the collective knowledge and expertise of a diverse group of forensic accountants and valuation experts.

our Services

Expertise in small to medium business valuations

Exit Strategy Planning

At Business Valuations Online, you can trust in the expertise of our team, regardless of why you need a valuation. Whether you’re assessing value for financial reporting, planning strategic moves, restructuring, or preparing for a transaction, our comprehensive, bespoke valuation reports are designed to streamline your decision-making process.

Restructuring and Operational Improvements

At Business Valuations Online, you can trust in the expertise of our team, regardless of why you need a valuation. Whether you’re assessing value for financial reporting, planning strategic moves, restructuring, or preparing for a transaction, our comprehensive, bespoke valuation reports are designed to streamline your decision-making process.

Funding and Capital Raising

At Business Valuations Online, you can trust in the expertise of our team, regardless of why you need a valuation. Whether you’re assessing value for financial reporting, planning strategic moves, restructuring, or preparing for a transaction, our comprehensive, bespoke valuation reports are designed to streamline your decision-making process.

Tailored financial solutions for your business needs

We deliver in-depth analysis and reliable insights to support decision-making, navigate complexities, and optimise outcomes. Our professional approach ensures clarity, confidence, and value for every stage of your business journey.

Beyond the Bullshit

by Brett Goodyer

Brett Goodyer is an expert in valuing businesses who wants to remove the gatekeeping bullshit that seeks to shroud valuations in mystery. Beyond the Bullshit provides a simplified, evidence-based approach and simplified theory, that can be applied to most small to medium businesses. It provides you with the insights that you need to help your clients maximise their valuation, giving you the ability to offer tangible advice that add value. Valuing businesses doesn’t have to be difficult, even though some concepts can be tricky. Brett’s straightforward approach helps you quickly grasp the basics. After reading and comprehending this book, you’ll be able to understand the concepts of appraising most small to medium businesses worldwide.

Case Studies

Our Team

Brett Goodyer

Co-Founder & CEO

Brett Goodyer is a seasoned professional and the esteemed CEO of Business Valuations Online and BVOPro. With a rich history dating back to 1993, Brett has garnered extensive experience in internal and information system audits, fraud investigations, and financial system roles. His true calling, however, lies in business valuation and forensic accounting.

Our Latest Articles

It’s the final quarter of the financial year, and now, the importance of integrating business valuations and appraisals with strategic tax planning becomes particularly significant....

Most accountants and small business operators have a pretty well tuned bullshit detector. You can smell a snake oil peddler from 20 paces. We all...

As financial professionals, we understand the importance of risk management in ensuring the success and longevity of our clients’ businesses. One critical factor to consider...

By Brett Goodyer, FCPA B.Com M.ForAccy – Forensic Accountant, Business Valuer, Bullshit Slayer Before you open Excel, open your ears. You can’t value a business if you don’t understand the owner, the risks, and the realities behind the numbers. This...

If you’ve ever been involved in a business sale that felt harder than it needed to be, there’s a good chance the business structure had something to do with it. I’ve seen deals drag out for months, and I’ve seen...